The proceeds generated from issuance of such bonds will be deployed in Public Sector projects which help in reducing carbon intensity of the economy.

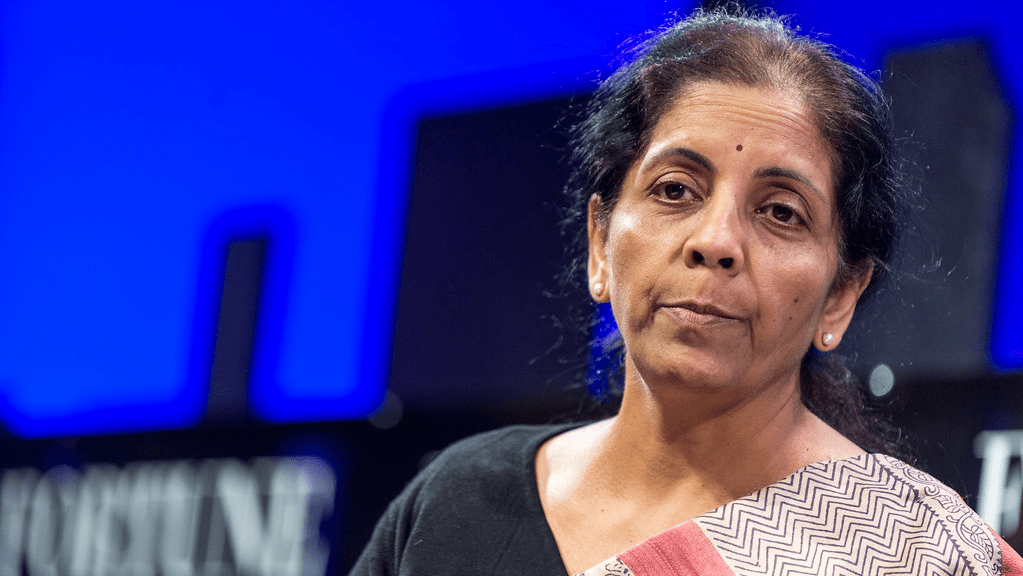

New Delhi: Union Minister for Finance and Corporate Affairs Nirmala Sitharaman on Wednesday approved the first Sovereign Green Bonds framework of India.

According to a statement by the Ministry of Finance, “This approval will further strengthen India’s commitment towards its Nationally Determined Contribution (NDCs) targets, adopted under the Paris Agreement, and help in attracting global and domestic investments in eligible green projects.”

The proceeds generated from issuance of such bonds will be deployed in public sector projects which help in reducing carbon intensity of the economy, the statement added.

The Framework comes close on the footsteps of India’s commitments under ‘Panchamrit’ as elucidated by Prime Minister Narendra Modi at COP26 at Glasgow in November 2021. The approval is fulfilment of the announcement in the Union Budget FY 2022-23 by the Union Finance Minister that Sovereign Green Bonds will be issued for mobilising resources for green projects.

What are green bonds?

Green bonds are financial instruments that generate proceeds for investment in environmentally sustainable and climate-suitable projects. By virtue of their indication towards environmental sustainability, green bonds command a relatively lower cost of capital vis-à-vis regular bonds and necessitates credibility and commitments associated with the process of raising bonds.

The statement further said, “In the above context, India’s first Sovereign Green Bonds framework was formulated and as per the provisions of the framework, Green Finance Working Committee (GFWC) was constituted to validate key decisions on issuance of Sovereign Green Bonds.”

Further, CICERO, an independent and globally renowned Norway-based Second Party Opinion (SPO) provider, was appointed to evaluate India’s green bonds framework and certify alignment of the framework with ICMA’s Green Bond Principles and international best practices. After due deliberation and consideration, CICERO has rated India’s Green Bonds Framework as ‘Medium Green’ with a ‘Good’ governance score, the statement said.