Sitharaman said the Reserve Bank of India (RBI) forms a critical part of inflation management, however, fiscal policy has to work together with the monetary policy in handling inflation.

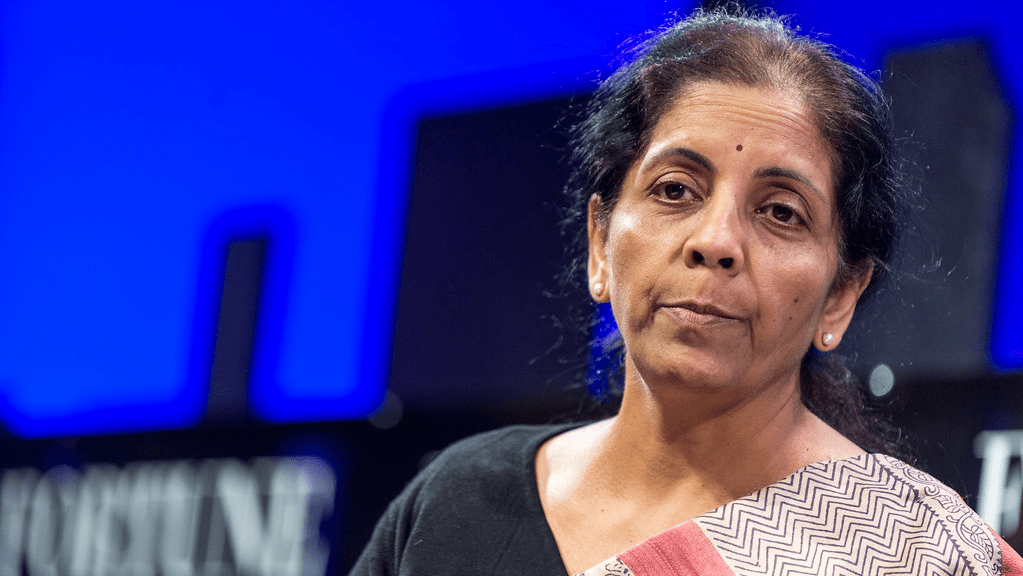

New Delhi: Union Finance Minister Nirmala Sitharaman on Thursday said inflation cannot be handled only by the Centre. She added that ways have to be found to work together with the states to manage inflation.

Sitharaman said the Reserve Bank of India (RBI) forms a critical part of inflation management, however, fiscal policy has to work together with the monetary policy in handling inflation.

Raking up the issue of higher fuel prices in some states, Sitharaman said the inflation is higher in those states. “Inflation that prevails in different parts of the country – despite the GST, creation of one market, removal of tolls and taxes, and freeing movement of goods – varies from state to state.”

She clarified by saying, “Now, I am not doing politics here but I’ll bring in an element where you might suspect I am bringing politics but it has definite relevance. At a time when global fuel prices went up, you wanted to be sure that burden is not passed on to the end consumer. Where it was possible and how much ever it was possible, the government twice reduced the price of petrol and products.”

She further said, “Very recently, widely available information in the public domain shows how inflation has varied from state to state. There could be several reasons for it…But the fact remains, coincidentally, I find inflation being higher than the national level inflation in states that have not reduced fuel prices.”

Sitharaman said she is not giving any forward direction to the RBI and said that even though the RBI has to synchronise its monetary policy with other central banks, it may not be synchronised as much as developed central banks.

“The Reserve Bank will have to synchronise. It may not be synchronised as much as developed central banks. I am not prescribing anything to the Reserve Bank, I am not giving any forward direction to the central bank. But it is the truth – India’s solution to handling the economy, part of which is handling inflation also, is an exercise where the fiscal policy together with monetary policy has been at work. It can’t be singularly left to monetary policy, which has proved totally ineffective in many countries. And these are countries whose structures form the basis for monetary policy theory, that interest rates are the potent tool to manage inflation,” she said.